Low Cost Asset Allocation Strategy – Vanguard and SPDR ETFs

This strategy exclusively utilizes low-cost Vanguard and SPDR exchange-traded funds. The clients that select this strategy are goal oriented and have partnered with me to create a tailored plan based on their unique financial situation. The goal of this strategy is not based on beating the market return. Instead, they believe in buy and hold, low-cost passive investment management.

I put your interests first and serve as a fiduciary for my clients

Before implementing this ETF strategy, I will take the time to understand your particular circumstances, goals, and aspirations. Even though this is a passive strategy, I will strive to deliver excellent investment results, service, and risk management. I will listen to your needs, and then develop a personalized plan and investment strategy that is based on your unique financial situation. I work hard to earn your trust as an adviser by creating investment solutions that address your evolving financial goals. I have a thorough understanding of legislative issues, best practices, and the role of a fiduciary.

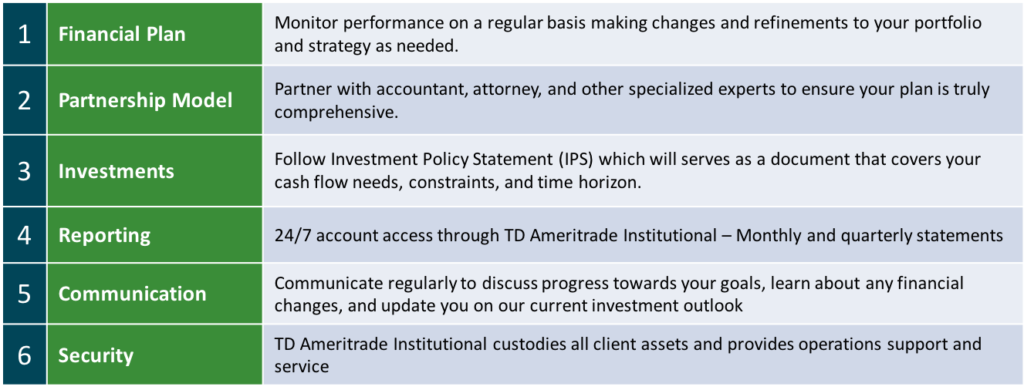

My approach to managing client assets is rooted in the following core strengths:

My Client’s Experience

My client’s experience is only one kind of relationship—the kind based on deep understanding and mutual respect. I strive to be accessible, proactive, and transparent with all my communications.

If you would like to know more about how my low-cost asset allocation approach can support your investment goals, feel free to send an email to mitch@cgfadvisor.com or schedule a meeting.

If you prefer a more active management with the goal to increase risk-adjusted returns, you can click here to learn more about my Absolute Return Strategy.

There is no assurance any investment strategy will be successful. Investing involves risk and investors may incur a profit or a loss.