Stephen Moore, who is a conservative economist, wrote a book last year titled Trumponomics: Inside the America First Plan to Revive Our Economy.

He defines Trumponomics, “as a new economic populism that combines some conventional Republican ideas–tax cuts, deregulation, more power to the states–with more traditional Democratic issues such as trade protectionism and infrastructure spending. It also mixes in important populist issues such as immigration reform, pressuring the Europeans to pay for more of their own defense, and keeping America first.”

At the core of Trumponomics, is bringing back jobs lost due to globalization. President Trump’s bold economic policies are beginning to reshape the U.S. economy. The adjustment has not been easy for investors nor the Federal Reserve Chairman Jerome Powell. It has given him fits. He has taken a sharp U-turn on his policies and went from potentially raising interest rates twice this year to potentially cutting interest rates twice.

The stock market rallied sharply this week because for the second time Chairman Powell caved to Trumponomics. The first time also resulted in a monster stock market rally. For Trumponomics to work, interest rates need to stay low. For example, you can’t negotiate hard with China over trade if the Federal Reserve is not expanding the U.S. economy. There is a major drawback to Trumponomics, which is excessive borrowing. The U.S. Federal deficit is expected to grow by $1 trillion and this is during booming economic times.

President Trump believes that the U.S. economy is bulletproof as long as the Feds cut rates and the federal government keeps printing money. But the uncertainty surrounding the trade war with China is beginning to put a strain on the economy. Economists expected a job gain of 178,000 on Friday, but employers only added 75,000 jobs. This time last year the 2018 May jobs report added 270,000. The economy and stock market has been resilient because expectations are that trade tensions will ease.

If you are a banker, real estate agent, or a mortgage broker, you have to love Trumponomics. The housing market couldn’t be any hotter. There hasn’t been a better time to sell your home. Mortgage rates have collapsed back to 3.75%, housing inventory is very low, and the demand for housing remains high as incomes rise. Another refinancing boom is also coming. It’s no surprise that this is all happening with a real estate tycoon in the White House. He wrote the book.

Trumponomics has caused the stock market to become extremely volatile. Next week, the stock market could lose all the gains from this week, or it could make new highs. It really depends on President Trump’s next move. I strongly believe that trade wars will not end with just Mexico and China. He has also said that he wants to make new trade deals with India, Europe, and other countries. He is just getting started.

If you support President Trump, you likely believe that Trumponomics is in the best long-term interest for the future of our country. If you don’t believe in Trumponomics, you likely believe that our country is being destroyed by these policies. I don’t think there is much of a middle ground. You either love it or hate it.

My clients fall on both sides of this line. Trumponomics could unleash growth as President Trump cuts a deal with China and Mexico, and now that interest rates are low, the economy would boom and the stock market would reach new highs. President Trump’s poll numbers would jump and he would be tough to beat in the 2020 election.

The bearish scenario is that the trade war with China escalates, which causes a global slowdown. Goldman Sachs wrote that trade jitters have dampened business hiring and investment could begin to take a political toll on Trump as the 2020 presidential campaign heats up. Higher tariffs could also cause inflation to return and the economy could become stuck in a stagflation type of environment of high prices and no growth.

The truth is nobody knows what will happen next. In the coming months, any economic expansion will be countered by any economic harm from Trump’s escalating trade war. I believe that President Trump’s focus may not be on the stock market and that he is fulfilling promises to his strong base of supporters. If he can get both to happen, a rising stock market and investors to look past trade wars, like he pulled off this week, it’s a huge win for Trumponomics.

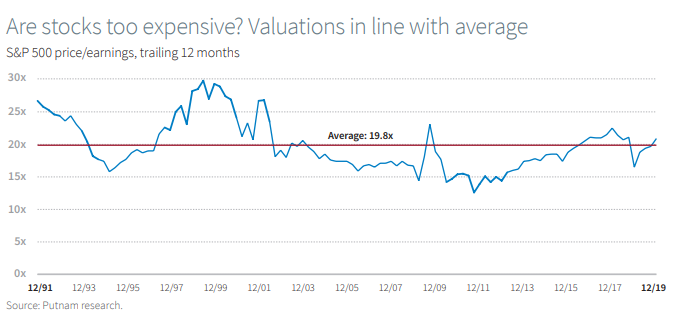

I’m managing client portfolios with more of a focus on higher dividends and income. Trumponomics also calls for higher diversification in stocks as well as bonds. It’s difficult to make any big bet in either direction. For retirees, it’s difficult to over-allocate into equities because a long term time horizon is needed just in case Trumponomics fails. I’m not saying that it will fail, but the underlying risk in the stock market has not been greater than at any point in the last 10 years. There is a scenario on the table that wasn’t there before which is that China doesn’t bend to President Trumps will. Mexico, as everyone expected, caved to President Trump’s demands, but I’m not so sure on China. Most investors believe that there will be a truce called and that the timeline will be extended to reach a deal. This is shaping up to be more of a long term battle.

I expect market volatility to continue and that it’s impossible to make any sense of these short term moves in either direction. My advice is to not pay much attention to the day-to-day and week-to-week market volatility. I’m comfortable with taking a balanced approach and if markets become cheaper, I’ll add to more dividend paying stocks. I hope that Trumponomics will be successful and that President Trump can continue to grow the U.S. economy, while at the same time, make fair trade deals.

Please read our disclosure statement regarding the contents of this post and our website as a whole.