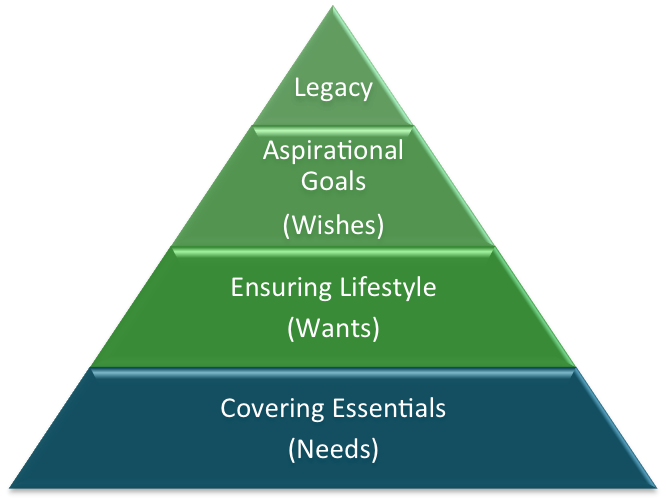

As you enter this new stage in your life, it is essential that you carefully build a retirement strategy so that you do not outlive your money. In our first meeting, I start with a personalized conversation to gain a deep understanding of your needs, wants, wishes, and concerns. I will capture all of this information and build a comprehensive retirement plan that breaks down your goals and helps to remove some uncertainty that you may face in retirement. Planning for a confident retirement starts with splitting your retirement finances into four main areas, which can be seen in the diagram below:

By addressing each of the above areas separately, it will help you visualize how you can achieve a comfortable retirement. The retirement plan is key to helping you organize your finances. Over your life you have accumulated assets, and like most pre-retirees, you have accounts scattered throughout the financial system. Now is the time to consolidate your assets so that you can gain more control over your investments.

I can help you build a personal cash flow statement which will estimate your cash inflows (pensions, Social Security, retirement assets, and personal properties) vs. cash outflows (rent/mortgage, monthly bills/expenses, health care costs, and cost of recreation.)

Once we have organized your investments, created a comprehensive retirement plan, and estimated your budget, I will help you to determine the best way to generate a retirement paycheck. There are many investment strategies that you can make without buying high expense products such as annuities.

In our first conversation, I will ask the following questions to help you visualize the type of lifestyle that you want in retirement.

- Where do you want to live?

- What is the list of activities or interests that will make you most happy in retirement – volunteering, spending time with family, gardening, sports, starting a new business?

- Are you going to travel – where and how often?

- Are you planning to be more active earlier in your retirement?

- How will your retirement evolve over time? Will it look different after 5 or 10 years?

- Do you have an emergency fund to meet unexpected challenges during retirement?

- Are there any expensive hobbies that will drain your savings?

- How do you plan to maintain social interactions after leaving your job?

- What type of lasting legacy do you want to leave for your family?

- Are there any final goals you wish to accomplish in your life?

Next, I will make realistic assumptions into your financial plan such as:

- Losing 40% of your buying power due to inflation over the next 18 years.

- Equity markets experiencing multiple corrections.

- Medical expenses increasing over 8% per year.

- Having a short-term stress on your budget due to unexpected emergency.

These realistic assumptions will help you to gain more of an accurate picture that will likely occur throughout retirement.

If you would like to speak with me about planning for a confident retirement or if you need investment help that aligns your risk tolerance with your financial goals, feel free to send an email to mitch@cgfadvisor.com or schedule a meeting.